AML/CTF Tranche 2 reforms for real estate

Understanding AML/CTF Rules 2025

The AML/CTF Act 2006 has been updated along with the AML/CTF Rules 2025 and accompanying Explanatory Statement. The Rules alone run to 120+ pages of legalese, obligations, definitions and reporting detail. First AML's compliance team has done the heavy lifting: translated it into plain-English, added real-world examples and highlighted what matters for the real estate sector.

Start here.

Make sense of AML/CTF Rules 2025, and learn what reporting groups mean for the real estate sector.

AML/CTF Rules 2025: A plain-English overview for busy professionals

Making sense of Australia's AML/CTF Rules for Tranche 2 entities.

Layman's guide to reporting groups

Understand business groups, elected reporting groups, lead entity requirements and compliance obligations

Reporting groups for the real estate sector

Learn what real estate agencies need to do to be compliant with Part 2: Reporting groups of the AML/CTF Rules 2025.

Next.

Find out how to enrol with AUSTRAC and set up an AML/CTF compliance program for the real estate sector.

Layman's guide to Part 3: Enrolment

Understand what service, business, group, and financial details you need to provide and how to keep your information up to date.

Enrolment for the real estate sector

Learn how real estate agencies can enrol with AUSTRAC and what it involves, key deadlines, and how to prepare smoothly.

Layman's guide to Part 5: AML/CTF programs

This part explains how to build a compliant program, covering risk assessments, CDD, PEP approvals, audits, reporting, and record-keeping.

AML/CTF programs for the real estate sector

Learn the core requirements of AML/CTF programs for real estate agencies, and what to prepare for 2026.

Finally.

Understand Customer Due Diligence requirements for the real estate sector and the reporting obligations that apply.

Layman's guide to Part 6: Customer Due Diligence

Learn what customer due diligence means, from ID checks and beneficial ownership to ongoing monitoring, enhanced checks, and record-keeping.

Customer due diligence for the real estate sector

This guide explains what the CDD requirements mean and how it works in practice for the real estate sector.

Layman's guide to Part 9: Reporting

Understand AUSTRAC's reporting rules: when to file Suspicious Matter Reports (SMRs), Threshold Transaction Reports (TTRs), and annual AML/CTF compliance reports.

Reporting for the real estate sector

Australian real estate agencies must lodge SMRs, TTRs in certain situations, and an annual AML/CTF compliance reports with AUSTRAC. Here's what you need to do and when.

Education and guidance by AUSTRAC

Guidance and educational materials are being developed to support both current reporting entities and Tranche 2 entities to implement effective AML/CTF measures.

AUSTRAC will provide further guidance in 2025, including:

- the scope of the new regulated services.

- core obligations and how they can be practically implemented.

- AUSTRAC is also developing AML/CTF starter program kits for small businesses in Tranche 2 sectors. The kits aim to increase the effectiveness of AML/CTF programs and will provide an AML/CTF program for a typical low complexity small businesses. They will reflect sector-wide money laundering, terrorism financing and proliferation financing risk and industry practice.

- AUSTRAC advises that guidance is being developed in close consultation with industry associations and peak bodies and will be released for public consultation in mid-2025.

Reform-related guidance currently available on AUSTRAC's website:

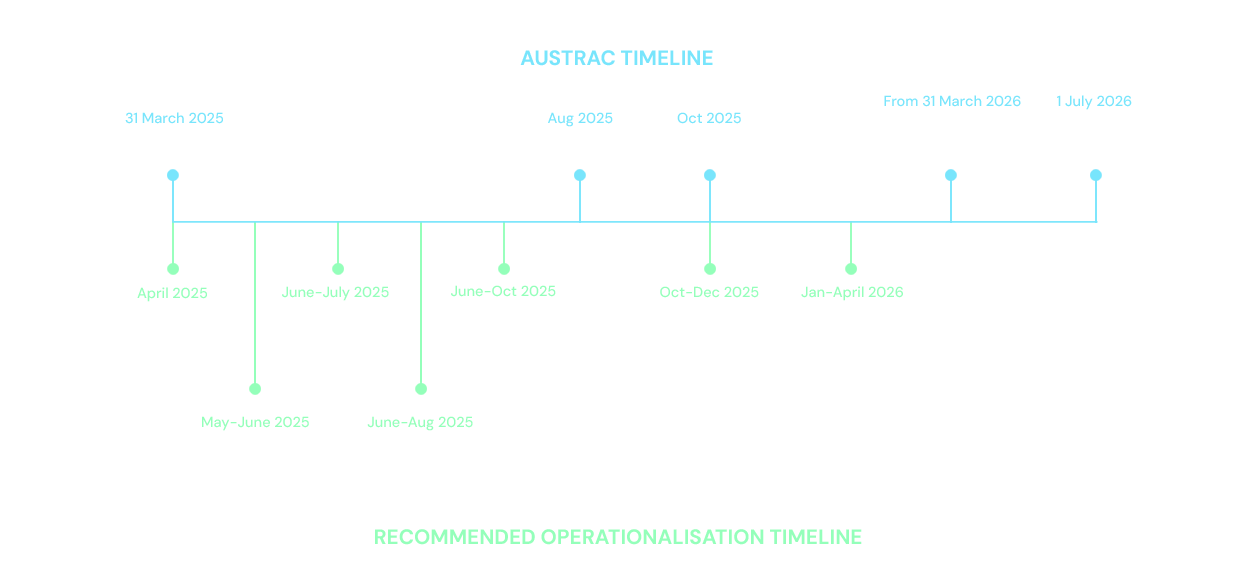

Key dates related to the reforms:

2024/25

- 29 November 2024: Passage of the AML/CTF Amendment Bill

- 10 December 2024: AML/CTF Amendment Act receives Royal Assent

- November 2024 to May 2025: Consultation on AML/CTF Rules

- 11 December 2024 to 14 February 2025 – First exposure draft consultation on AML/CTF Rules

- 7 January 2025: Repeal of Financial Transaction Reports Act 1988

- 31 March 2025: Commencement of changes to the tipping off offence

- May to July 2025: Targeted consultation on draft core guidance in working groups with industry associations and peak bodies

- August 2025: Finalisation of AML/CTF Rules

- October 2025: Finalisation of core guidance

- October to November 2025: Targeted consultation on Tranche 2 sector-specific guidance in industry working groups

- December 2025: Finalisation of Tranche 2 sector-specific guidance

2026

- 31 March 2026: Changes to obligations for current reporting entities and virtual assets service providers

- 1 July 2026: AML/CTF obligations commence for Tranche 2 entities

- 29 July 2026: New reporting entities to enrol by this date.

- 2026: Ongoing enhancements to the sector-specific guidance for current reporting entities in partnership with industry.

- Post 2026: International value transfer service reporting will commence under transitional arrangements (previously referred to as ‘international funds transfer instruction’ reporting).

Tranche 2 guidance

Once your business is registered, you are a "reporting entity" and need to keep up with your obligations under the Act. These quick guides aim to help you fulfil your compliance obligations.

Helpful links

AML/CTF bill and rules

- Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Rules 2025

- Anti-Money Laundering and Counter-Terrorism Financing Act 2006

- Anti-Money Laundering and Counter-Terrorism Financing Amendment Bill 2024

- The Senate Legal and Constitutional Affairs Legislation Committee Report - AML/CTF Amendment Bill 2024

- Exposure Draft on the Anti-Money Laundering and Counter-Terrorism Financing Rules

- Consultation into the Anti-Money Laundering and Counter-Terrorism Financing Rules

FATF guidance

Get the tools, templates and expert advice you need for Tranche 2.

- Expert-led webinars with practical advice

- Ready-to-use templates, guides and tools

- Real-world insights from compliance officers in New Zealand and the UK

- Common pitfalls (“war stories and gotchas”) to avoid costly mistakes